Health care plan lien claim negotiation — Section 3040

Simplification of Civil Code section 3040: A “five Cs” negotiation guide

[The material presented in this article was first presented at the 2016 CAALA Las Vegas convention. It is part of the author’s compendium entitled “Lien Guide for the Trial Attorney,” which will soon be made available to CAALA members.]

Civil Code section 3040 is a very valuable negotiation tool. This code is a gift to the plaintiff’s trial bar, as it provides statutory limitations on health-plan and disability-insurance-plan lien claims. Because the code is a basic negotiation tool, it cannot be used as evidence, placed in a jury instruction or used in argument. (Civ. Code, § 3040, subd.(i).

Section 3040 became law in 2000, but there is no known case law explaining its application. (There is a brief recognition of section 3040 by the California Supreme Court in Parnell v. Adventist Health System/West (2005) 35 Cal.4th 595, 604-605 [26 Cal.Rptr.3d 569].) Nor is there much literature on how to apply section 3040’s lien reductions.

Although section 3040 sets forth several lien-claim reduction categories and ceilings on lien recovery, it does not require a chronology for its application. Additionally, a lack of court interpretation of section 3040’s lien-claim reductions and ceiling limitations allows for creative application.

This article breaks down section 3040’s complexity and provides a simplified “five Cs” negotiation guide. The guide is explained in detail with examples.

Title of Civil Code section 3040

Section 3040 is entitled: “Lien for money paid or payable by insured or enrollee for health care services provided under health care service plan contract or disability insurance policy; limit on account.” Note that the title includes “disability insurance policy” lien claims. Thus, lien-claim reductions and lien recovery ceilings set forth in the code equally apply to health care service plan lien claims and disability-insurance lien claims.

The term “health plan” is generally used throughout this article to include “health care service plan contracts” complying with the Knox-Keene Act and “disability insurance policies” subject to the Insurance Code.

Although section 3040’s title references a “lien for money,” the claim is technically not a lien. Rather, it is a right to seek reimbursement from a monetary recovery by an injured insured from a third-party tortfeasor.

3040 applies to “health care service plans” complying with the Knox-Keene Act

Subdivision (a) of section 3040 sets forth the types of health-care service plan entities bound by its terms. Such entities broadly include health maintenance organizations (HMOs), health insurance companies including preferred provider organizations (PPOs), and other medical groups qualified under the Knox-Keene Health Care Service Plan Act of 1975 (§§ 1340-1399.818 and Title 28 of California Code of Regulations).

Health plans that are in compliance with Health and Safety Code § 1340 et seq. (Knox-Keene Act) are managed by the California Department of Managed Health Care (DMHC). A health plan typically contracts with a medical treater and pays the treater for the medical service provided to health plan beneficiaries for itemized billing (noncapitated) or a flat fee (capitated). It is the health plan that submits the lien claim, not the medical treater, unless the medical treater qualifies under the Knox-Keene Act.

The list of health plans that qualify under the Knox-Keene Act, and, thereby are subject to the deductions set forth in Civil Code section 3040, can be found on the DMHC website. The easiest way to find the list on the DMHC website is to go the section concerning filing a complaint. The list is then a step away.

At this writing, there are 123 Knox-Keene Act entities on the DMHC website subject to section 3040 reductions and ceilings. They include:

- HMOs, such as Kaiser

- Health insurance companies, such as Blue Cross, Humana, Scan, etc.

- Eye care facilities (several)

- Chiropractic facilities (several)

- Pharmacies (several)

- Psychological centers (several)

A “disability insurance policy subject to Insurance Code” also is bound by section 3040’s lien claim reductions and recovery ceilings.

3040 does not apply to non health-care service plans

Section 3040 has no application to contracted liens with individual medical providers or to treaters who render medical service where there is no insurance coverage. Nor does section 3040 apply to liens under self-administered ERISA programs, Medicare reimbursement claims, MediCal benefits (Welf. & Inst. Code, § 14124.70 et seq), government statutory lien claims, hospital liens claims under Civil Code section 3045.1 et seq., and workers’ compensation liens.

Contractual lien provision is required

At the time a new enrollee executes a medical agreement for health care services, the health care plan usually has the new enrollee execute a boilerplate “lien” or “reimbursement” agreement against recovery from a third party tortfeasor. Although the contract may state the health plan has a lien on the recovery, no actual lien exists. It is merely a contractual right to seek reimbursement from the monetary recovery of the insured from a third party tortfeasor.

If the health plan (usually a collection agency) makes a claim for reimbursement, the health plan should be required to produce the contract. If there is no contractual provision allowing for a lien or reimbursement, no such right exists. That right is not created by statute.

Note that without statutory authority, an insurance company or health plan providing medical benefits cannot require an assignment of tort recovery benefits or subrogate (direct action) into the matter. (See Block v. Cal. Physicians’ Services (1966) 244 Cal.App.2d 266.) Some statutes that do allow for subrogation are Civil Code section 3045.1 et seq., regarding statutory hospital liens; Labor Code section 3856, for workers’ compensation benefit reimbursements; Government Code section 23004.1, for services provided at a county facility; and Government Code section 13963, for victims of violent crimes.

The Five Cs

Once you have reviewed the contract to ensure the lien claimant has a contractual right to seek reimbursement from its insured’s third-party tort recovery, section 3040 lien claim negotiations can commence. Use of the following “five Cs” reduction guide can simplify negotiations under section 3040:

- Co-pay reductions (non statutory)

- Capitation – 20 percent reduction – (subd. (a)(2))

- Comparative fault negotiable reduction – (subd. (e))

- Common fund reduction – (subd. (f))

- Ceiling on lien claim recovery – (subd. (c) & (d))

Applying the “five Cs” guide to reduce lien claims

Step 1. First reduction for co-pays – Any health-plan lien claim should be scrutinized to assure it does not include co-pays for services rendered, double billings, deductibles and unrelated medical care. (Not technically recognized as a reduction item in section 3040, but an itemized lien claim should be demanded and reviewed to assure co-pays, double billing, deductibles and unrelated medical care are not included in the lien claim.)

Thus, the FIRST health plan lien claim reductions include co-pays made by the injured party for services, double billings, deductibles and unrelated medical care.

Additionally, it should be argued that the health-plan lien claimant is required to prove the services rendered and now being liened were “reasonably and necessary charges,” as now required by a hospital alleging a Hospital Lien Act claim under Civil Code section 3045.1. (See State Farm v. Huff (2013) 216 Cal.App.4th 1463, 1469 [157 Cal.Rptr.3d 863].)

Step 2. Second reduction based on capitated service – Section 3040 sets limits on a health plan’s lien claim recovery, based upon whether the health plan pays the medical treater for patient services as incurred (noncapitated) or the treater is paid a flat fee (capitated) by the health plan:

(a) “Noncapitated” beneficiaries under a health plan receive itemized bills for services from medical-care treaters. The health plan then pays all or a portion of the itemized bill to the medical care treater. The code limits the health plan’s lien claim for noncapitated services to a sum that does not exceed the “reasonable costs” of “the amount actually paid” by the health plan to the medical care treater. (§ 3040, subd. (a)(1))

(b) “Capitated” beneficiaries receive health care services from a medical-care treater, and no specific itemized billing is created. The health plan contracts with the treater to provide a large number of patients for a per capita charge. Kaiser beneficiaries fall into this category. When a lien payment is made by Kaiser, for example, section 3040 requires a calculation of its lien claim to “the amount equal to 80 percent of the usual and customary charge for the same services by medical providers [treaters] that provide health care services on a noncapitated basis in the geographic region in which the services were rendered.” [Life care planners can assist in obtaining the “usual and customary charge” referenced in the code.] (§ 3040, subd. (b)(2).)

When a medical treater normally provides capitated service but the health plan pays a noncapitated bill, such as an ambulance bill, that “noncapitated” bill is liened by the health plan for the reasonable costs actually paid. (§ 3040, subd. (b).)

Thus, the SECOND health-plan lien claim reduction, when dealing with a capitated lien claim, is to reduce the gross lien claim by 20 percent. (There is no reduction from noncapitated service charges [unless the bill is shown to be unreasonable], as the entire billing for noncapitated service is a recoverable lien by the health care provider.)

Step 3. Third lien claim reduction for comparative fault is allowed “[w]here a final judgment includes a special finding by a judge, jury, or arbitrator, that the enrollee or insured was partially at fault ....” Note that a “finding” is required, and, thus, a potential comparative fault reduction should be negotiated with the lien claimant prior to any settlement with the tortfeasor. (§ 3040, subd. (e))

Thus, the THIRD health plan lien claim reduction should be for the anticipated, or actual, percentage of comparative fault expected to be assessed by a third-party tortfeasor against the injured insured.

Step 4. Fourth Lien claim reduction based on common-fund doctrine for attorney fees and costs. “A lien subject to subdivision (a) or (b) is subject to pro rata reduction, commensurate with the enrollee’s or insured’s reasonable attorney’s fees and costs, in accordance with the common fund doctrine.” (§ 3040, subd. (f))

Thus, the FOURTH health plan lien claim reduction is a pro rata percentage reduction of the insured’s reasonable attorney fees and costs charged for recovery against the third-party tortfeasor.

For case law defining the common-fund doctrine, see US Airways v. McCutchen (2013) 133 S.Ct. 1537, 1545; Lee v. State Farm (1976) 57 Cal.App.3d 458 [129 Cal.Rptr. 271]; and Century v. Sup.Ct. (Quintana) (2009) 47 Cal.4th 511 [96 Cal.Rptr.3d 516].

Step 5. Fifth lien claim reduction based on statutory ceiling – Unless the noncapitated or capitated lien claim is less, section 3040 provides a percentage ceiling (cap) on “any final judgment, compromise, or settlement agreement,” to the following extent [after co-pay reductions (step 1 above), after 20% reduction for any capitated medical care (step 2 above), and after any anticipated comparative fault reduction (step 3 above)]:

(a) When an attorney is engaged by the injured party – The health plan’s lien claim recovery may not exceed 1/3 of the net money due the injured client after deduction of attorney fees and costs (and perhaps other medical bills not liened). (§ 3040, subd. (c))

(b) When no attorney is engaged by the injured party – The health plan’s lien claim recovery may not exceed more than 50 percent of the case result (presumably after all other expenses, including nonliened medical billing, are deducted). (§ 3040, subd. (d))

Thus, the FIFTH health plan lien claim reduction is a ceiling (cap) on the healthcare provider’s lien recovery, and it is dependent on the net tort recovery the injured insured is to receive from a third-party tortfeasor.

Note: the statute is silent on how to calculate reductions from multiple lien claimants. Therefore, there is an opportunity to be creative. One writer suggests all lien claims are to be equally shared from the net lien payment, as calculated in the above examples.

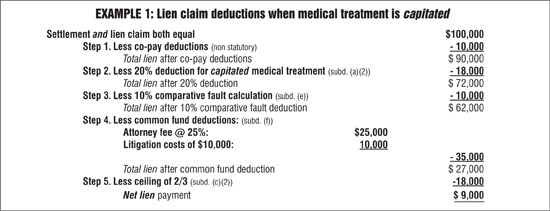

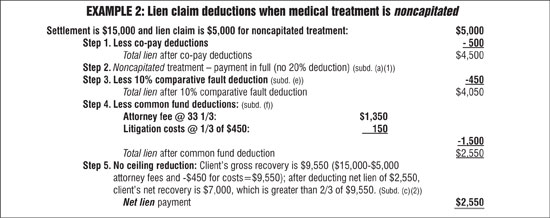

Examples – Using section 3040 to reduce health-plan lien claims

The statute does not specify any required order for lien-claim reduction, and there is no case law guidance. Therefore, chronological calculations using section 3040 statutory deductions need not be the same for all lien-claim negotiations. Two examples where section 3040 is used to reduce legitimate lien claims are shown above. These examples represent a very small set of facts out of endless settlement patterns. Note that the two examples apply the “five Cs” set forth above. The first example is based on a capitated lien claim; the second example uses a noncapitated lien claim.

Michael S. Fields

Michael Fields has lectured and written on arbitration law and procedures for over 25 years. He retired from the active practice of law after a 47-year career as a plaintiff’s personal injury trial attorney. He remains a licensed member of the California State Bar. Mr. Fields was the 2003 CAALA president, and he was the 2015 recipient of CAALA’s Ted Horn Memorial Award for his many contributions to the profession.He can be contacted at msflb@aol.com.

Copyright ©

2026

by the author.

For reprint permission, contact the publisher: Advocate Magazine