Liability Medicare set-aside challenges and changes

Medicare set-asides are not presently required in liability (PI) settlements, but you need to create a defensible position for certain clients

Medicare Set-Asides (MSA) in liability (PI) cases have never been a clear and concise topic for plaintiffs. The Center for Medicare & Medicaid Services (CMS) has provided some guidance regarding Medicare Set-Asides. Last year, CMS published Change Request 9893, which suggests CMS may adopt Workers Compensation Medicare Set-Aside guidelines and begin applying them in liability cases. At the current time, liability MSAs are not required. However, a conservative approach dictates that Medicare’s future interest should be considered and plaintiffs should appropriately document their files.

Historical overview

In 1980, 42 U.S.C. section 1395y(b)(2)(A)(ii) was enacted, which is commonly referred to as the Medicare Secondary Payer Statute (MSP). It states:

Payment under this subchapter may not be made…with respect to any item or service to the extent that…

(ii) payment has been made, or can reasonably be expected to be made under a workmen’s compensation law or plan of the United States or a State or under an automobile or liability insurance policy or plan (including a self-insured plan) or under no fault insurance. (Emphasis added.)

Subsequently, since 2003, 42 C.F.R. 411.46 has stated that Medicare’s future interest must be considered in any workers’ compensation settlement when the client might rely on Medicare to cover any future medical costs related to the covered work injury. The CFR only addresses workers’ compensation and mentions nothing about liability settlements. That being said, CMS’ position is that when there is funding for future medical expenses in a liability settlement, “payment has been made” for future treatment that would have otherwise been covered by Medicare. Therefore, Medicare is secondary and those funds must be exhausted to pay future-related treatment of the type normally covered by Medicare.

Between 2003 and 2011, CMS published memos on how to consider and protect Medicare’s future interest in Workers Compensation Settlements, but those memos do not address Liability Settlements.

On May 25, 2011, the CMS Dallas Regional Office issued a letter stating the 1980 MSP statute requires us to consider Medicare’s future interest in liability cases when there is a recovery for future medical expenses. It fails, however, to address how Medicare’s future interest should be taken into consideration.

In June 2016, CMS announced that it was considering expanding its voluntary MSA amount-review process to include the review of proposed liability insurance and no-fault-insurance MSA amounts. CMS added that there would be future announcements of the proposal within the next year.

Change request 9893

On February 3, 2017, CMS distributed Change Request 9893, which addressed liability MSAs and No-Fault- Insurance Medicare Set-Asides (NFMSA). It defines a liability MSA (LMSA) and/or NFMSA as an allocation of funds from a liability or an auto/no fault-related settlement, judgement, award or other payment that is used to pay for an individual’s future medical and/or prescription-drug treatment expenses. The Change Request addressed the following:

The policies, procedures and system updates required to create and utilize an LMSA and NFMSA MSP record, “similar to a Workers’ Compensation Medicare Set-Aside Arrangement” and

Instruct the A/B Medicare Administrative Contractors (MACs), Durable Medical Equipment MACs and shared systems when to deny payment for items or services that should be paid from an LMSA or NFMSA fund. (Emphasis added.)

The Change Request had an effective date of July 1, 2017 and a final implementation date of October 2, 2017.

This Change Request addressed the contractors’ and operators’ role. It did not address the plaintiff’s roles and responsibilities. This does not mean plaintiffs should not take this seriously. Plaintiffs should continue to carefully consider their future duties to Medicare.

Current guidance: Very little

There is currently little guidance from CMS on how to consider Medicare’s future interest in a liability case. On May 25, 2011, a CMS Dallas Regional Office memo stated that Medicare’s future interest needs to be considered when there is a recovery for future care. However, this memo specifically stated that it is “not to be considered a CMS official statement of policy.” On September 29, 2011, another CMS memo stated that Medicare’s future interest is satisfied when a treating physician states that no future-related treatment or prescriptions are required.

Absent any published policy or guidelines regarding future medical benefits in liability settlements, each plaintiff should 1) adequately consider Medicare’s future interest and 2) appropriately document your file that you have done so. At present, an MSA is never required. The terms “Medicare Set-Aside” do not exist in any statute or regulation. It is CMS’ vehicle of choice in protecting the Medicare Trust and it provides a safe vehicle for settling a claim for future medical expenses and for the post-settlement administration of an allocation.

What should plaintiffs do now?

While there are no guidelines on how to protect Medicare’s future interest in a liability case, CMS has issued guidelines on when they will review an MSA determination in workers’ compensation cases. CMS prefers that workers’ compensation MSAs be established in a settlement or award and submitted to CMS for its review and approval when resolution of the dispute includes a commutation aspect where the primary payer is seeking to close out future benefits, and 1) the injured individual is currently a Medicare beneficiary and the case settles for greater than $25,000; or 2) the injured individual is reasonably expected to be a Medicare recipient within 30 months of the date of the settlement and the total value is greater than $250,000.

“Reasonable expectation” means that the individual: 1) is 62.5 years old, 2) is currently receiving SSDI, has applied for SSDI or has been denied SSDI benefits and anticipates or is in the process of appealing or reapplying for benefits. This guideline for reviewing MSA arrangements in a workers’ compensation setting has evolved into an industry standard of when Medicare’s future interest needs to be protected in a liability case.

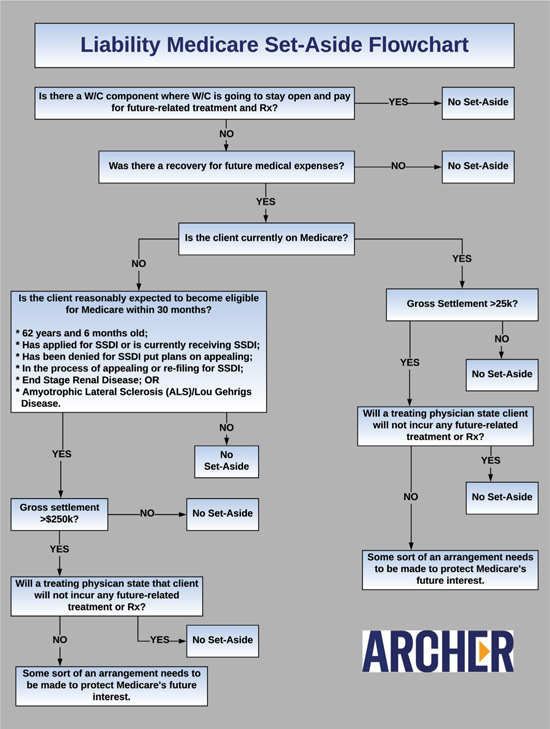

The flowchart (See Figure 1) can be used as guidance for when an LMSA may be necessary in your liability (PI) settlement.

Conclusion

The future of liability MSAs is uncertain. Given CMS Change Request 9893, CMS may be gearing up to make changes to liability MSAs. While there is no rule or regulation requiring an MSA in a liability settlement, there is a directive to the operators to deny payment in certain situations. Plaintiffs should therefore continue to be mindful about Medicare’s future interest. For the most conservative approach, plaintiffs can look to the Workers’ Compensation MSA guidelines and appropriately document their files. In the end, plaintiffs and their counsel need to be in a defensible position should Medicare ever question their LMSA decisions.

© 2017 Consumer Attorneys of California. Reprinted with permission from Forum magazine, Nov/Dec 2017.

Clayton Starnes

Clayton Starnes is with Archer Systems, LLC in Austin, TX. He is one of the nation’s leading experts in providing complex subrogation and benefit planning solutions to injured plaintiffs across the country in individual and mass tort cases. LienTeam.com

Amanda Greenburg

Amanda Greenburg is with Archer Systems, LLC, with offices in Oakland. She is an attorney focusing on Medicare Set-Asides and lien resolution. LienTeam.com

Copyright ©

2026

by the author.

For reprint permission, contact the publisher: Advocate Magazine