Special-Needs Trusts

Identifying clients on means-tested government benefits during the client intake interview allows counsel to take the necessary steps to preserve those government benefits

Recent government policy changes are affecting common means-tested benefits that can arise during the personal-injury settlement process. These new policy changes provide injured clients with greater flexibility when it comes to administering their Special- Needs Trusts (SNTs) to preserve eligibility for government benefits such as Medi-Cal (California’s Medicaid program) and Supplemental Security Income (SSI).

Increased flexibility

In March 2018, the Social Security Administration (SSA) made sweeping changes to its Program Operations Manual System (POMS). This SSA internal policy is more restrictive than state Medicaid, making POMS the primary foundation for trustees when administering SNTs. The changes to POMS have been immensely positive for clients utilizing SNTs and make these trusts more attractive.

Here are a few of the most significant policy updates.

Secured VISA cards for clients

The new policy no longer requires SNT clients to “ask permission” from a trustee before every purchase. Clients create a spending plan with their trustee. The trustee then loads a VISA card with a set amount of funds to cover expenses in the spending plan. These expenses can be adjusted at any time as issues arise. At the end of the month, clients submit their receipts to the trustee and their card is then replenished. The secured debit cards also have a multitude of protections and restrictions that can be placed on the card to fit a client’s unique situation.

“Sole Benefit” replaced with “Primary Benefit”

The former policy stated that the client had to be the only person benefiting from a product or service. Under the updated policy, the trustee only needs to ensure that the client benefits the most from a product or service. For example, purchasing a TV that other members of the family may occasionally watch is now an acceptable disbursement.

Increased caregivers

Previously, the SSA would take issue when an SNT paid for more than one caregiver, regardless of the needs of the client. This policy can be widely inappropriate for clients with severe disabilities, especially when traveling. Now, SSA will not take issue paying for an appropriate number of companions to care for a client when away from home.

Using Achieving a Better Life Experience (ABLE) accounts

The intention of the ABLE program is to allow clients receiving means-tested benefits to learn how to save and manage their own money. These accounts are most often used with small settlements. To qualify for an ABLE account, a client must be disabled prior to age 26 and can only contribute up to $15,000 a year. Trustees of SNTs can now use ABLE accounts with a trust to avoid a Presumed Maximum Value Reduction for SSI recipients.

What are clients losing by signing a disclosure and taking cash?

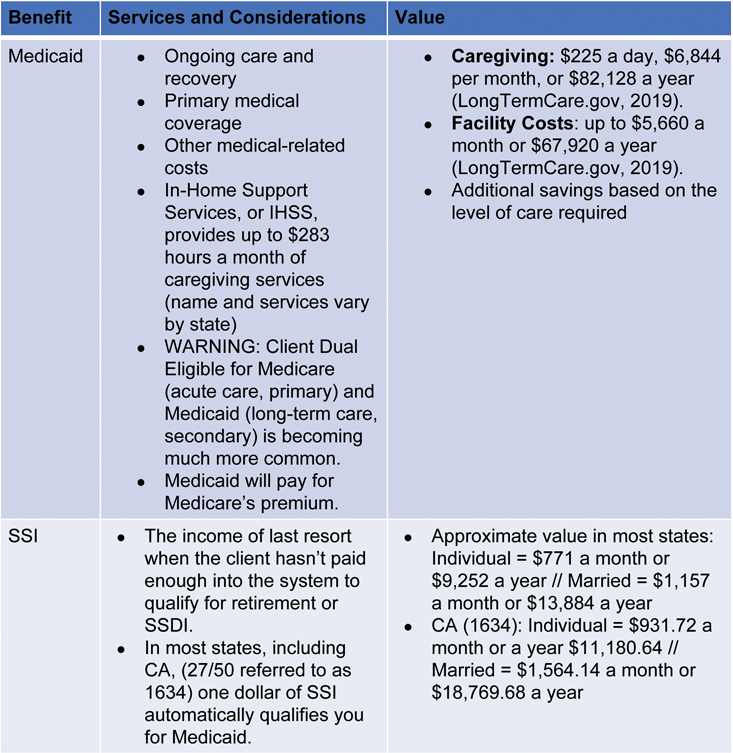

The most common forms of means-tested benefits are Medi-Cal (Medicaid) and Supplemental Security Income. Both are statutorily protected by an SNT (42 U.S.C. § 1396p(d)(4)(C).) If clients receive either benefit, plaintiff’s counsel could be unintentionally barring a client’s eligibility from the benefits they depend on. To illustrate this, here is a snapshot of the services and approximate monetary value these programs provide. (See Figure 1)

As outlined in Figure 1, Medicaid provides the highest value to a client, especially when the client has extensive care needs that require caregiving or skilled nursing services. In contrast to many other states, it is uncommon for a client with extensive care needs to receive the maximum of 283 hours of in-home caregiving hours every month in California. In many situations, these hours can be paid from Medi-Cal to a family member to help raise the household income, but this should be discussed with a qualified attorney or trust officer beforehand.

It’s also important to address the threat of misappropriation. Many clients on means-tested benefits have never possessed a large sum of money. This inexperience can result in hard-fought settlements being spent down quickly or misappropriated. A structured settlement is commonly utilized to ensure the funds last over a designated term selected by the client, but this does not protect a client from spending payments inappropriately or from taking poor financial advice from friends and relatives.

Most trustees offer a Settlement Management Trust with trigger powers into an SNT to ensure that the client is protected by a third-party trustee without subjecting the funds to Medicaid’s first right of recovery at the time of death. This also protects an anticipated need for eligibility for means-tested programs later in life.

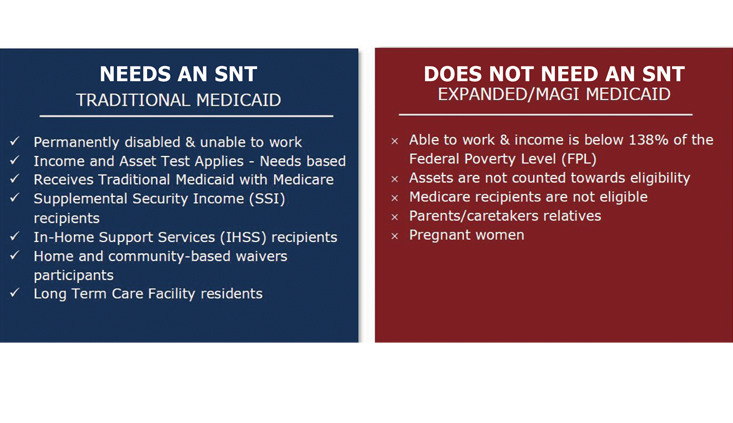

Medi-Cal does not always need protection

Not all clients receiving Medi-Cal require additional action post-settlement to protect their Medi-Cal benefit. It’s important to understand the difference between the common program types of Medi-Cal upfront. Here are the basics. When in doubt, contact a qualified attorney or trust officer.

Expanded Medi-Cal

Expanded Medi-Cal, also known as Modified Adjusted Gross Income (MAGI) based Medi-Cal, is for families with low income and will not be lost due to a settlement. Clients on this form of Medicaid are typically working or receiving some form of income equal to or less than 138% of the Federal Poverty Limit based on household size. Expanded Medi-Cal only has an income test and does not have an asset test. In other words, a client on Expanded Medicaid can receive any amount of cash or income through a qualified structured settlement and remain eligible for this program (42 CFR 435.603.) This type of Medicaid does not cover caregiving services or a skilled nursing facility. If the client will require these services in the future, client’s counsel should consult with a qualified attorney or trust officer to determine the appropriate options.

Medically Needy Medi-Cal

In contrast, clients on Medically Needy Medi-Cal are disabled and unable to work. Medically Needy Medi-Cal is means-tested (i.e., contains an income and resource test to be eligible), largely because it provides the most expensive services: long-term caregiving and skilled-nursing services. Clients often qualify for Medically Needy Medi-Cal if they receive a form of income from the Social Security Administration that requires them to already be determined disabled and are under the income and asset limits. Common examples of these forms of income include SSI, Social Security Disability Insurance (SSDI) and Social Security Retirement. A future application for these forms of income or an anticipated need for long-term care services often require considering the protection of this benefit.

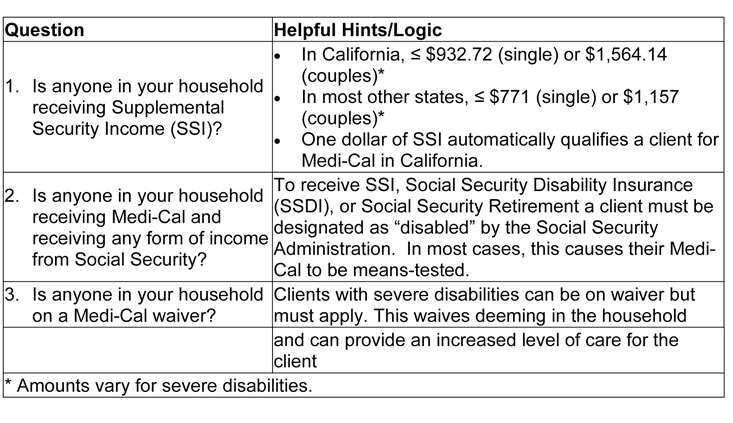

Identifying clients where “deeming” is an issue

In the client intake interview, questions about household income and benefits must be asked due to the threat of spousal and parental “deeming.” Deeming is when accepting a settlement would cause the client’s spouse or child living in the same household to lose their eligibility for means-tested benefits (SI 01320.001.) Parental deeming only applies top-down, meaning child-to-parent(s) deeming does not apply. The good news for most families is that even if a parent receives a settlement and their child is receiving Medi-Cal and/or SSI, there are certain thresholds for earned and unearned income that the parent can receive before impacting their child’s eligibility (See Figure 3).

Here are examples using qualified structured settlements to ensure longevity and tax-free growth.

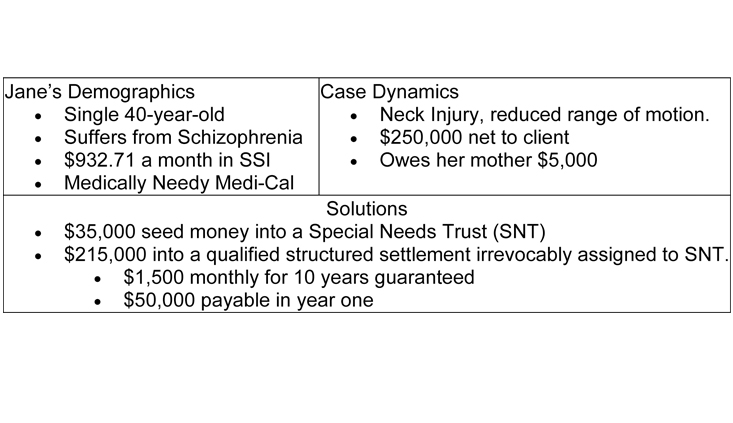

Jane’s scenario

Jane Doe (See Figure 4) receives Social Security of $932.71 a month. As described earlier, this amount indicates that this form of income is at least partially SSI. Additionally, in California, one dollar of SSI means she is also receiving Medically Needy Medi-Cal in California. Jane will lose her eligibility for both Medi-Cal and SSI if she accepts the settlement as a structured settlement or as a lump sum.

This is a common scenario for trustees of SNTs. The only red flag is the “loan” her mother provided while she was recovering from her neck injury. This usually raises suspicion from the Social Security Administration if not documented correctly because it’s a common form of misappropriation. For a loan to be satisfied properly, it must be “bonafide,” meaning there must be a written or oral agreement of repayment at the time the loan was provided.

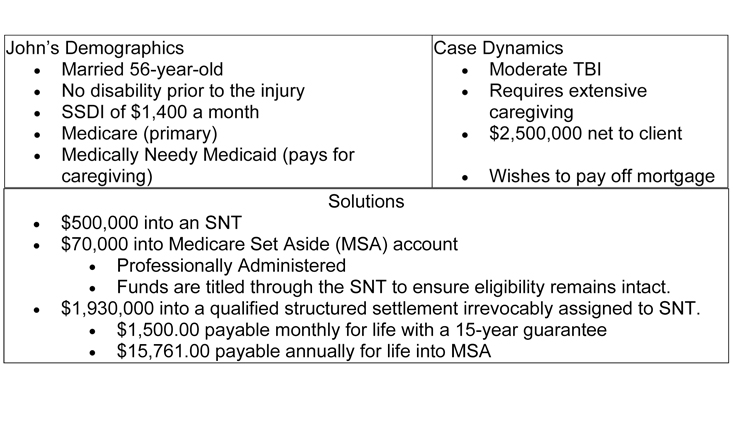

John’s scenario

John Doe (See Figure 5) is receiving $1,400 a month from “Social Security.” His attorney determines that this is Social Security Disability Insurance based on the amount, and his work history of at least 10 years (or 40 work quarters). John suffers from a traumatic brain injury (TBI) and requires extensive caregiving. A Medicare Set-Aside (MSA) has been established to protect Medicare’s interest.

John’s wife is providing care to her husband but wishes to return to work. She is comfortable providing most of the care at night and on the weekends. To eliminate the threat of spousal deeming from the wife’s income, the family applies for a Medicaid waiver.

When an individual is married and a spouse decides to continue working or be paid for caregiving, it is important to apply for a waiver immediately because the application process can take anywhere from a few weeks to several months. Once approved, John’s wife can return to work without any concern of John losing his eligibility for Medi-Cal.

In-Home Supportive Services IHSS) grants John approximately nine hours a day of care payable to an external caregiver while his wife is at work. An SNT is established and will be used to pay his wife or additional caregivers for any care provided at night and on weekends (beyond IHSS hours). Since John will require a caregiver for the rest of his life, a structured annuity is purchased to ensure the longevity of caregiving funds.

Summary

Identifying clients on means-tested government benefits during the client intake interview allows counsel to take the necessary steps to preserve government benefits. This allows clients to maximize their settlement and increase the level of care they receive. Additionally, with new POMS policies in place, the flexibility provided by a Special Needs Trust has never been greater.

Patrick Farber

Patrick Farber is a structured settlements broker with Atlas Settlement Group in Southern California. He works with attorneys throughout the country to create structured settlement annuities for physical and non-physical injury cases. He provides support and advice during all phases of the settlement process – at no cost to attorney or client. pat@patfarber.com.

Cameron Lindahl

Cameron Lindahl is the Senior Trust Officer at CPT Institute. Cameron is responsible for leading CPT Institute’s mission as a 501(c)(3) charity to provide free education and training for the legal community on protecting government benefits for the injured and at-risk. Additionally, he regularly conducts training in various settings across the country. cameron@cpttrust.org.

Endnote

Special-Needs Trusts

Copyright ©

2026

by the author.

For reprint permission, contact the publisher: Advocate Magazine