Medicare set-aside funds no longer count toward state Medi-Cal eligibility and asset limits

New laws effective July 1 permit disabled persons to keep more assets while still qualifying for Medi-Cal benefits

California’s 2022 budget includes wording that dramatically increases the amount of assets a disabled person can retain and still be eligible for Medi-Cal coverage.

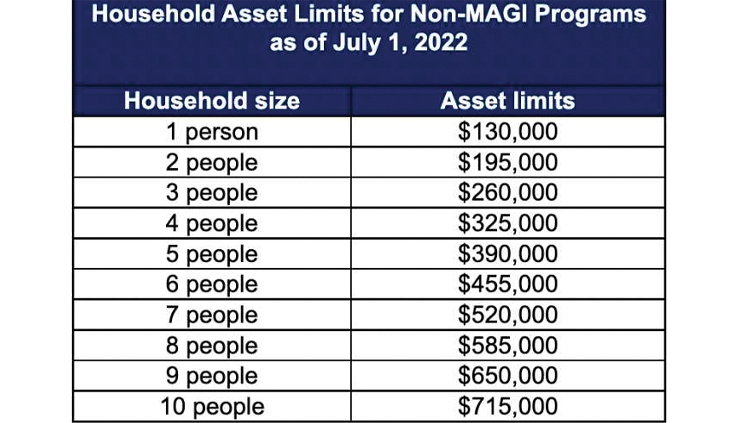

Previously, California (as with all other states), would cap a disabled individual’s assets at $2,000 (not including a home or vehicle) to qualify for Medi-Cal coverage. As of July 1, 2022, California will increase the cap to $130,000 with an additional $65,000 per family member living in the household. Assets in Medicare Set-Asides (MSAs) are not counted as income when determining traditional or expanded Medi-Cal eligibility.

This change means injured parties will be able to keep at least $130,000 in assets and any amount of funds in an MSA account and still maintain eligibility for traditional or expanded Medi-Cal benefits including long-term care. More good news: Asset limits will be phased out entirely by July 1, 2024 if additional funding passes.

There is one major catch, however: The beneficiary must reside in California. If they move out of state, the asset limit reverts to $2,000. Injured parties would have to establish a Special Needs Trust (SNT) in the new state, liquidate their assets to under $2,000 and transfer MSA assets into a trust.

Genesis of the change

In late 2020, California enacted two laws that had a major impact on how SNTs are used in the state. First, California assembly bill AB 184 (State Budget Act of 2021) was successfully funded to allow for the increase in the asset cap. In addition, AB 133, a comprehensive revision to the delivery of health-care services, greatly expands Medi-Cal eligibility. The asset test changes come in two phases – step one starts July 1, 2022 with the $130,000 increase, then, if funded by July 1, 2024, the asset test will be eliminated altogether.

Section 50402 (Cal. Code Regs., tit. 22, § 50402) specifically addresses the issue of MSA assets. The law makes it clear that MSA assets are not counted towards the Medi-Cal asset limit. These laws ensure that people with disabilities can maintain their Medi-Cal eligibility and receive the benefits they need.

Medicare Set-Aside accounts

MSAs (or Workers’ Compensation Medicare Set-Asides, known as WCMSAs) are financial agreements that set money aside to pay for future medical services related to a personal injury or workers’ comp injury, illness or disease. The money in the MSA must be used before Medicare will pay for treatment. (All County Welfare Directors Letter 90-01, Cal. Code Regs., tit. 22, § 50402, 50513, and 50515.)

MSA funds are considered unavailable income when applying for California’s Medi-Cal program. This means that the state does not include the money when determining if someone qualifies to receive help from Medi-Cal. (Cal. Code Regs., tit. 22, § 50515(a).)

Unavailable income includes the part of workers’ compensation and other public or private insurance settlements (including structured settlements) that is set aside to pay for medical, legal or other expenses. It also includes the part of the settlement that is not controlled by the applicant or beneficiary. The money made from interest on an interest-bearing account is not counted when concluding whether a disabled party is eligible for a program that does not count towards income. The money in an MSA is not considered income or property, whether the MSA is self-administered or administered by a third party.

The rationale for having an interest- bearing account for an MSA or WCMSA is that it will be used for its intended purpose – which is to offset costs that would have been paid by Medicare for injuries related to ICD 9 or ICD 10 diagnosis codes related to a plaintiff’s injuries (essentially a hold-back for all related diagnosis codes that are related to injuries). Annual reports to the Centers for Medicare and Medicaid Services (CMS) are required. CMS also has the right to audit the account. Dividends and interest are defined as gross unearned income under state regulations. (Cal. Code Regs., tit. 22, § 50507.)

How it works

If an account is identified to the county as an MSA by the applicant, the county will typically ask for supporting documentation to demonstrate that the account is an MSA. This documentation can include:

The court order or letter that explains the agreement between the people involved (settlement agreement)

The account documents associated with the settlement agreement

Medi-Cal Asset Test Limits documentation

If these documents are unavailable, the individual needs to provide a written affidavit signed and dated under penalty of perjury as to why.

The new $130,000 limit, with an additional $65,000 per family member living in the household was part of California’s budget that was approved by Governor Newsom. Eliminating the asset test entirely by January 1, 2024 will impact over two million Californians.

People who are over 65 or have a disability can receive Medi-Cal through a program that has different income and asset limits. The limits are the same each month, but the program has different limits for how much people can own. Caution: Monthly earned-income limits based on household modified adjusted gross income and number of dependents still apply.

While the revised rules for disabled Californians are good news, it is important to understand how they will work. Here are key points:

The new asset limit is a significant increase from the current limit of $2,000.

These rules apply to California residents only. If applicants/plaintiffs move out of state, they will need their MSA and assets over $2,000 placed into a Special Needs Trust.

The new asset limit only applies to Medi-Cal beneficiaries. If a person receives Social Security Disability Insurance (SSDI) with a Supplemental Security Income (SSI) subsidy, the asset limit is still $2,000.

The new asset limit will only apply to assets that are considered “countable.” This includes cash, savings, investments and some types of property.

The $130,000 cap includes both liquid and non-liquid assets, such as real estate.

Medi-Cal recipients will now have an easier time getting the care they need. However, before distributing settlement funds, there are other factors to consider.

If the injured plaintiff or a family member/dependent receives government benefits, they are still required to notify the applicable government agency whenever there is a change in their assets, income or resources.

Failure to give notice to the state agency may result in a suspension of benefits for up to three years in California and five years in all other states without proof of notice. With proof of notice, the state agency cannot suspend benefits while waiting for a fair hearing, which can take up to 600 days. Notice is required by the 10th calendar day of the month after receiving funds.

California is a 1634 state, meaning if a plaintiff gets at least $1 of Supplemental Security Income (SSI) the plaintiff automatically qualifies for Medi-Cal. Therefore, plaintiffs who receive less than $1,040 a month from SSDI may be subsidized with SSI to qualify for Medi-Cal.

Patrick Farber

Patrick Farber is a structured settlements broker with Atlas Settlement Group in Southern California. He works with attorneys throughout the country to create structured settlement annuities for physical and non-physical injury cases. He provides support and advice during all phases of the settlement process – at no cost to attorney or client. pat@patfarber.com.

William E. Lindahl, MBA, CLPF

William E. Lindahl, MBA, CLPF is the national enrollment director for CPT Special Needs Trusts providing pooled trusts. He is a California Licensed Professional Fiduciary with 25 years of experience meeting the needs of the disabled. He has developed Pooled Trust programs nationwide and online trust administration systems. will@snthelp.com.

Copyright ©

2026

by the author.

For reprint permission, contact the publisher: Advocate Magazine